Why the bankruptcy stigma, when medical debt is No. 1 cause?

Oct 11, 2021, 5:56 PM

Photo: Adobe Stock

SALT LAKE CITY — A stigma surrounding bankruptcy persists, despite the fact that the top two reasons people go bankrupt in the first place are (1) medical expenses and (2) job loss — scenarios debtors may not have control over.

A survey reported by CNBC found that two-thirds of all bankruptcies were tied to medical issues, either because of the high costs for care or time out of work.

A 2015 study by the Kaiser Family Foundation found that medical bills caused 1 million U.S. adults to declare bankruptcy every year and that 26% of Americans ages 18 to 64 struggled to pay medical bills, according to World Population Review.

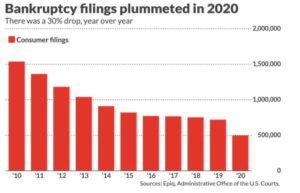

However, there’s proof that Americans filed fewer bankruptcies in recent years, and that Americans were able to pay down debt during the COVID-19 pandemic.

So why does the stigma persist?

First, the good news

The pandemic shuttered shops and restaurants and closed workplaces as jobs dried up. Yet bankruptcies in America dropped during the lockdown — 496,565 consumer bankruptcy petitions were filed last year. That’s the lowest number since 1987. And it represents a 31% decline from 2019 according to MarketWatch.

The total number of new US Chapter 7 and Chapter 11 bankruptcy cases filed for the 12 months ending June 30, 2021, was the lowest since 1985, according to the Administrative Office of the U.S. Courts.

The federal government’s stimulus package helped stave off evictions for renters and put money in the pockets of the unemployed. It even allowed for many to pay down existing debt. As of May 26, 2021, Uncle Sam has sent out approximately $391 billion directly to taxpayers, bringing the total number of payments to almost 167 million, reported CNBC.

A financial blemish on your record

Why does it carry this stigma? Dave Noriega and Debbie Dujanovic asked Certified Financial Planner™ Shane Stewart with Deseret Mutual Benefit Administrators (DMBA).

“It’s assumed that, whether it’s true or not, it’s assumed that they’ve mismanaged their money,” Stewart said.

“That’s probably where the biggest stigma comes. The other part of the stigma comes from not only mismanagement but . . . it’s assumed that that person is just trying to leave their debtors high and dry.”

The different types of bankruptcy

Stewart explained the two types of bankruptcy that he deals with. The first, Chapter 7 bankruptcy, allows liquidation of assets to pay creditors.

Under Chapter 7, “your unsecured debt is discharged, but you do have to liquidate some assets. Now many people choose that, in fact, over 70% of bankruptcies are Chapter 7 because many times they don’t have assets to take,” Stewart said.

Chapter 13 is a reorganization of a debtor’s finances under the supervision and approval of the courts.

“It [Chapter 13] takes a little longer. You’re agreeing with creditors to — over time — take some time and pay maybe less on the payments until you can get your feet under you,” Stewart said, adding about 28% of US bankruptcies are filed under Chapter 13.

But before you file …

Before declaring bankruptcy, Stewart recommended seeking out a nonprofit credit-counseling service.

“There are a couple even locally in the Wasatch Front that are funded by grants,” Stewart said. “They help you try to reorganize your debts before having to declare bankruptcy. I would try it out first.”

Dave & Dujanovic can be heard weekdays from 9 a.m. to noon. on KSL NewsRadio. Users can find the show on the KSL NewsRadio website and app, a.s well as Apple Podcasts and Google Play.

Related reading:

-

Dave & Dujanovic discuss COVID-19 and bankruptcy

-

Bitcoin’s crash is very bad news for other cryptos

-

Are boys and girls receiving different financial lessons?