EXPLAINER: How to get up to $3,600 per child in tax credit

Feb 9, 2022, 7:27 AM

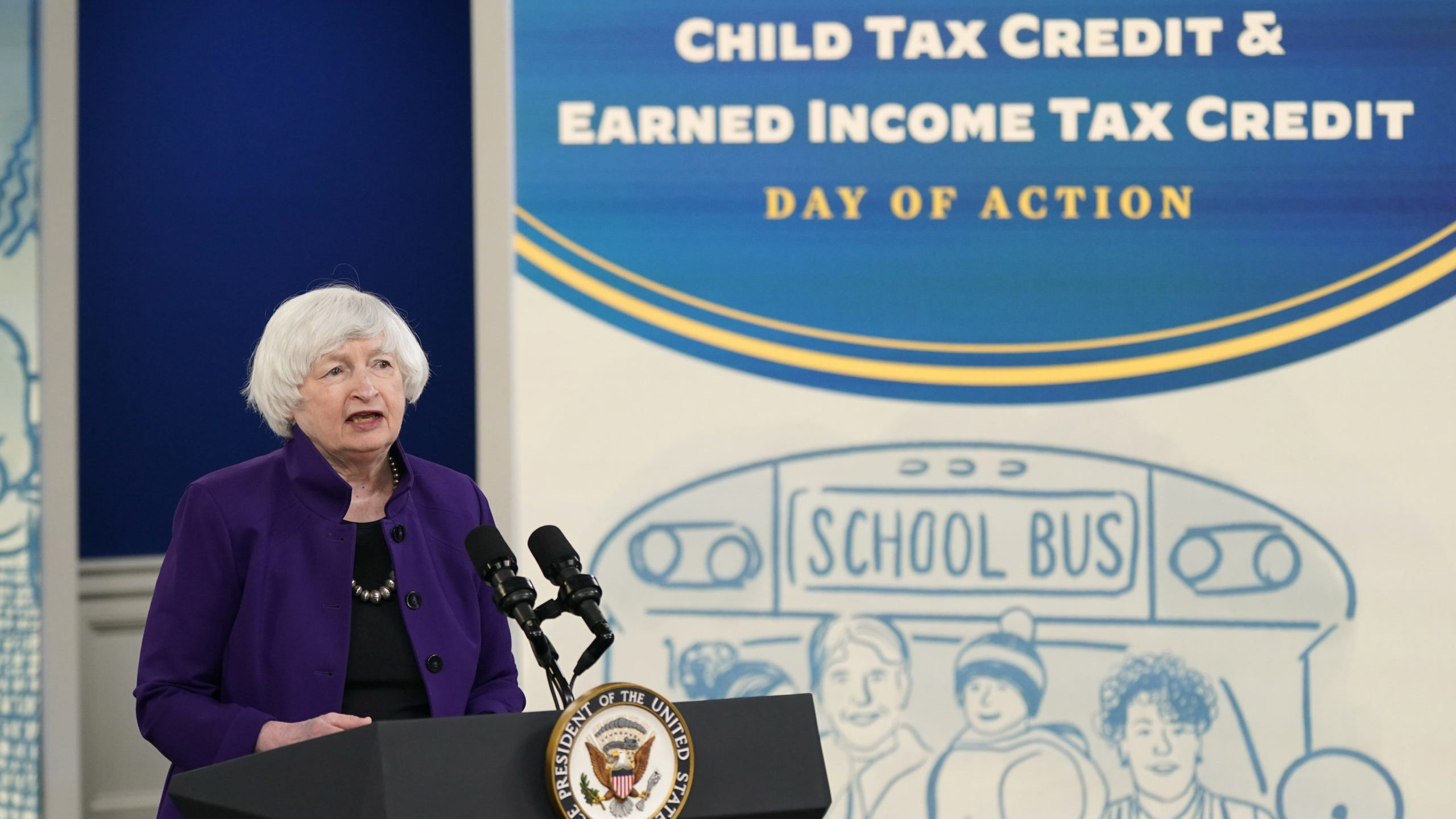

Treasury Secretary Janet Yellen encourages Americans to take advantage of tax credits, including the expanded Child Tax Credit and Earned Income Tax Credit, in the South Court Auditorium on the White House campus, Tuesday, Feb. 8, 2022, in Washington. (AP Photo/Patrick Semansky)

(AP Photo/Patrick Semansky)

WASHINGTON (AP) — Millions of Americans who have never filed a tax return will need to do so this year in order to claim what’s coming to them under the enhanced child tax credit.

Previously, only people who earned enough money to owe income taxes could qualify for the full credit.

But as part of the $1.9 trillion coronavirus relief package, President Joe Biden expanded the program, increasing the payments to up to $3,600 annually for each child aged 5 or under and $3,000 for those who are ages 6 to 17.

The monthly payments have amounted to $300 for each child 5 and younger and $250 for those between 5 and 17.

The government began to send the payments out — an overall $93 billion — on a monthly basis starting last July. Now, there are an additional six months’ worth of payments waiting to be claimed. And some families haven’t collected any of the benefits they’re due yet. In all, an estimated $193 billion is yet to be claimed.

The only way to receive that money is to file a tax return.

Some questions and answers about who’s eligible for the credit and how to get it:

WHO GETS THE CHILD TAX CREDIT?

More than 36 million families received the advanced payments in December alone, which marked the last month that advanced monthly payments were sent to households. Families qualify for the full credit if their 2021 adjusted gross income was at or below $150,000 for married couples filing a joint return, or $75,000 for single-filer parents.

HOW DO I KNOW IF I QUALIFY AND WHAT IF I DON’T OWE TAXES?

Whether or not a family owes tax money or has filed taxes before, they will need to file a return to get all or the rest of their money.

Eligible families that didn’t receive any advance child tax credit payments during 2021 can still claim the full amount of the child tax credit on their federal tax return. Those families that are unsure of whether they’ve received payments, or potentially received paper checks that went uncashed, can visit the Child Tax Credit Update Portal, to see how much of the credit they should have received.

Additionally, families that received payments should have received a “Letter 6419, 2021 advance CTC” notice, which includes information on the amount of advance payments families have received and tax information for filing purposes.

However, the IRS has said that some people may have received incorrect information on their forms. The portal can help people who want to confirm the correct amount they should have received. Despite any inconsistencies in documentation, the IRS advises that taxpayers should keep the letter, and any other IRS communications about advance payments, with their tax records.

WHAT IS THE BEST WAY TO FILE?

The IRS urges individuals to file their taxes electronically to process forms quicker, and provides links on the agency website to free filing sites like GetYourRefund.org, which helps families earning less than about $66,000 a year file their taxes for free. The organization partners with IRS-certified Volunteer Income Tax Assistance, and provides free help in English and Spanish. Another option is MyFreeTaxes.com, which provides virtual assistance to people who make $58,000 or less to file their federal and state taxes for free. That service is offered through the United Way.

The IRS also has a tool to help individuals identify other free file sites that offer tax filing help.

WHAT IF I LIVE OUTSIDE THE 50 STATES?

While the coronavirus relief package included child tax credit benefits for residents of Puerto Rico, they were not eligible to receive the advance monthly payments. Instead, Puerto Rican residents can receive the full amount of child tax credit that they are eligible for by filing a federal income tax return this year. Additionally, residents of American Samoa, the Commonwealth of the Northern Mariana Islands, Guam or the U.S. Virgin Islands may be eligible for the full child tax credit payments, but they will need to contact their local U.S. territory tax agency.

WHO CAN HELP ME SORT THIS OUT?

The IRS has launched a website, called ChildTaxCredit.gov, which lists criteria that filers must meet in order to receive the full credit. Additionally, the federal agency will begin offering walk-in assistance with IRS volunteers in limited locations for individuals who need help filing their taxes, beginning Feb. 12.

Thirty-five tax assistance centers around the country will be open from 9 a.m. to 4 p.m. on the second Saturday of the next four months.

The tax filing deadline is April 18.