The gas tax and education: a voter’s guide to Q1

Oct 22, 2018, 2:48 PM | Updated: Nov 8, 2022, 11:40 am

Getty Images

SALT LAKE CITY — Voters will choose in November whether to support a 10 cent gas tax increase aimed at boosting funding for public schools and local roads. But as it is currently written, many voters may not realize that voting yes or no on this measure won’t have any immediate impact.

Nonbinding Opinion Question 1

The key word here is “nonbinding.” Essentially, Utah lawmakers wanted to know how voters feel about a tax increase without having to first commit to one.

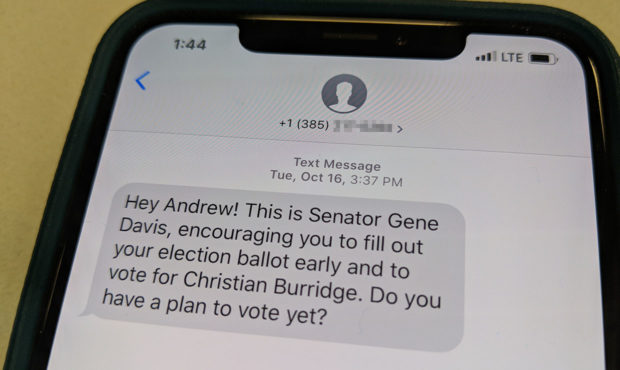

The ballot question asks voters whether the state should increase the motor and special fuels tax rate by the equivalent of 10 cents per gallon. Since it does not take action right away, a yes vote from residents would mean the Utah legislature would have to pass a bill in the 2019 legislative session to increase the tax.

Where would the money go?

The resolution goes on to explain that the 10 cent gas tax increase would actually be aimed at shoring up funding for transportation in Utah. The language reads:

“WHEREAS, approximately $600 million is taken from the state’s General Fund to subsidize the Transportation Fund each year,” going on to state, “if the state’s Transportation Fund is more self-sustaining, more resources in the General Fund will be available for use by the state public education system.”

In other words, this measure specifically raises funds for transportation. While lawmakers have indicated their intent is to then put more General Fund money toward education once the Transportation Fund is more stable, there is no guarantee schools would always get more money, or exactly how much more money schools would get.

How much is the gas tax now?

Currently, Utah’s state gas tax is 29 cents per gallon. That gets added to just over 18 cents per gallon in federal excise taxes on gasoline, for a total of 47.81 cents in combined state and federal taxes. That’s just slightly below the national average for combined state and federal gas taxes and fees of around 52.12 cents per gallon.

How did we get here?

Nonbinding Opinion Question 1 is the direct result of a compromise reached between Utah lawmakers and a group called Our Schools Now, which was originally seeking a sales tax and income tax increase for education in Utah. The group sought to raise about $700 million per year for schools through its initiative.

Instead, Our Schools Now and lawmakers reached an agreement on two legislative measures. First, House Bill 293 froze property tax rates that otherwise might have been reduced, resulting in a net gain for education funding. Second, lawmakers approved House Joint Resolution 20, submitting the nonbinding question to the lieutenant governor to include on the November ballot.

If approved by voters and then again by the legislature, it’s estimated that Question 1 would result in an addition $375 million in education spending for Utah.

Arguments for Question 1

Our Schools Now continues to lead the support for the nonbinding resolution, with political ads airing all over. The group says providing better funding for transportation will result in more money reaching Utah children, as transportation needs will no longer be robbing the general fund. Gov. Gary Herbert has also publicly supported the resolution.

Arguments against Question 1

Taxpayer watchdog groups including Americans for Prosperity and the Utah Taxpayer Protection Alliance PIC have publicly opposed the resolution, arguing that the increase comes just a year after the legislature increased the gas tax. They also point toward Utah’s $650 million budget surplus in 2018, and argue the state already spends more of its budget by percentage than any other state in the country.

Where do voters stand?

Voters appear to be split. A Dan Jones and Associates poll released in September found about 50 percent of Utahns support or strongly support the gas tax increase, with 47 percent opposed and 3 percent undecided. Those results are within the poll’s 3.4 percent margin of error.

LaVarr Webb, the UtahPolicy.com publisher, thought the complex way in which the money is moving may explain the tight results.

“The bottom line is, if you support this, it’s more likely education will get more money. But behind that simple statement is some complexity,” Webb said in an interview with KSL.com.