Sweeping tax reform passes, with some last-minute changes

Dec 13, 2019, 7:10 AM | Updated: 1:08 pm

Photo: Colby Walker | KSLNewsRadio

SALT LAKE CITY — Utah state lawmakers have approved a sweeping tax reform package.

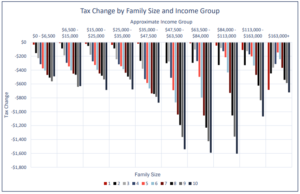

The bill lowers the income tax rate while raising the sales tax on food, gas and some services.

Lawmakers said they are aiming to offset the higher costs of sales tax on food by sending out ‘pre-bate’ checks to low- and moderate-income residents as part of some last minute changes they made to the bill

Supporters of the new tax law say those increased sales taxes are necessary.

“Until we get a tax base that grows with population, we’re not going to be able to fund the problems that population bring,” said Sen. Lyle Hillyard.

“The primary responsibility as legislators, in terms of the tax reform, is to keep our economy strong to keep us moving in a positive direction, and I think that that is exactly what this does,” said Rep Bradley Last.

But opponents said it creates a burden.

“I know that for some individuals, a dollar, or two dollars or four dollars means nothing. But there’s a lot of working families in our communities where that is the difference between a gallon of milk or diapers for their babies,” said Sen. Luz Escamilla.

The Utah Constitution earmarks all income tax toward education, so some things will need changing in the general session.

“What is the rush, particularly when we don’t have an essential piece?” asked Heidi Matthews, the president of the Utah Education Association. “It sends the message that that, we’re doing just fine and we’re not.”

Lawmakers say the idea is to focus more income tax revenue on K-12 rather than higher ed and see how local LEAs and property taxes can bring in a bigger share.

The bill now goes to the Governor. Lawmakers voted mostly along party lines Thursday night.

But because the bill did NOT get a 2/3 majority in the House, it could conceivably be voted on by the public in a referendum.

See the full changes here: 4th SUB Tax Restructuring Revisions Summary 12-12-2019-final