Gov. Herbert calls special session to address tax reform

Dec 10, 2019, 6:38 PM | Updated: 9:54 pm

Utah Governor Gary Herbert has called a special session of the Utah Legislature to address tax reform. (Photo: Getty Images)

(Photo: Getty Images)

SALT LAKE CITY — Utah Gov. Gary Herbert has called a special session of the Utah Legislature in order to address tax reform.

The special session will begin at 4 p.m. on Thursday, December 12. Discussion on tax reform is scheduled to begin at 5 p.m.

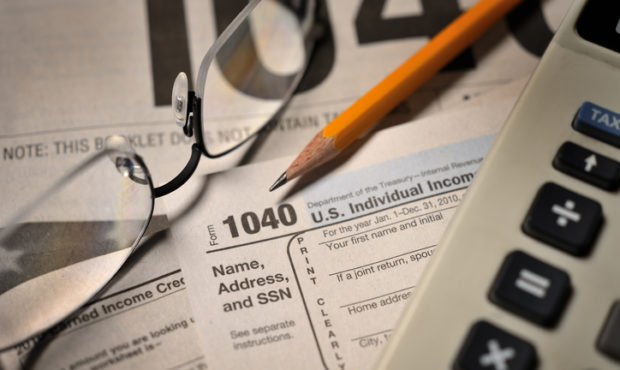

The push for a special session, less than two months from the upcoming general session of the legislature, is to provide Utah residents the ability to take advantage of new tax tables for the year ending December 31, 2019.

“I am tremendously grateful to the Utah Legislature for the time, attention, problem-solving, and effort that they have dedicated to restructuring our tax system over the last eleven months,” Herbert said in a statement emailed to KSL NewsRadio.

“Stabilizing our tax system is necessary,” the statement continued. “The growth rate of our income tax, which funds education, increases every year. Meanwhile, the growth rate of our sales tax, which funds all other government services, increases much more slowly.”

Scheduling of the special session came just one day after a committee, tasked with recommending tax reforms, voted 6-3 to recommend a bill to the full Utah Legislature. The general public had an opportunity to see the bill just three days prior to that.

A bill attempting to address what lawmakers call a “structural imbalance” in Utah’s tax revenue in the 2019 Legislative Session did not advance. At that time, lawmakers said the bill was trying to address too many issues too quickly. In part, the governor said in a statement, that is what is driving a special session:

After much consideration, I have concluded that this bill should be addressed in a special session, so that legislators can carry out their duty of setting base budgets available for allocation during the upcoming general legislative session.

The bill in question would raise taxes on food and gasoline. It would also raise taxes on certain services like Uber and some veterinary services, as well as place a six-cent excise tax on diesel fuel.

The bill would lower income taxes by about $160 million.

This story will be updated.