Market corrections; scary but sometimes a good thing

Feb 28, 2020, 6:30 AM | Updated: Mar 12, 2020, 9:26 am

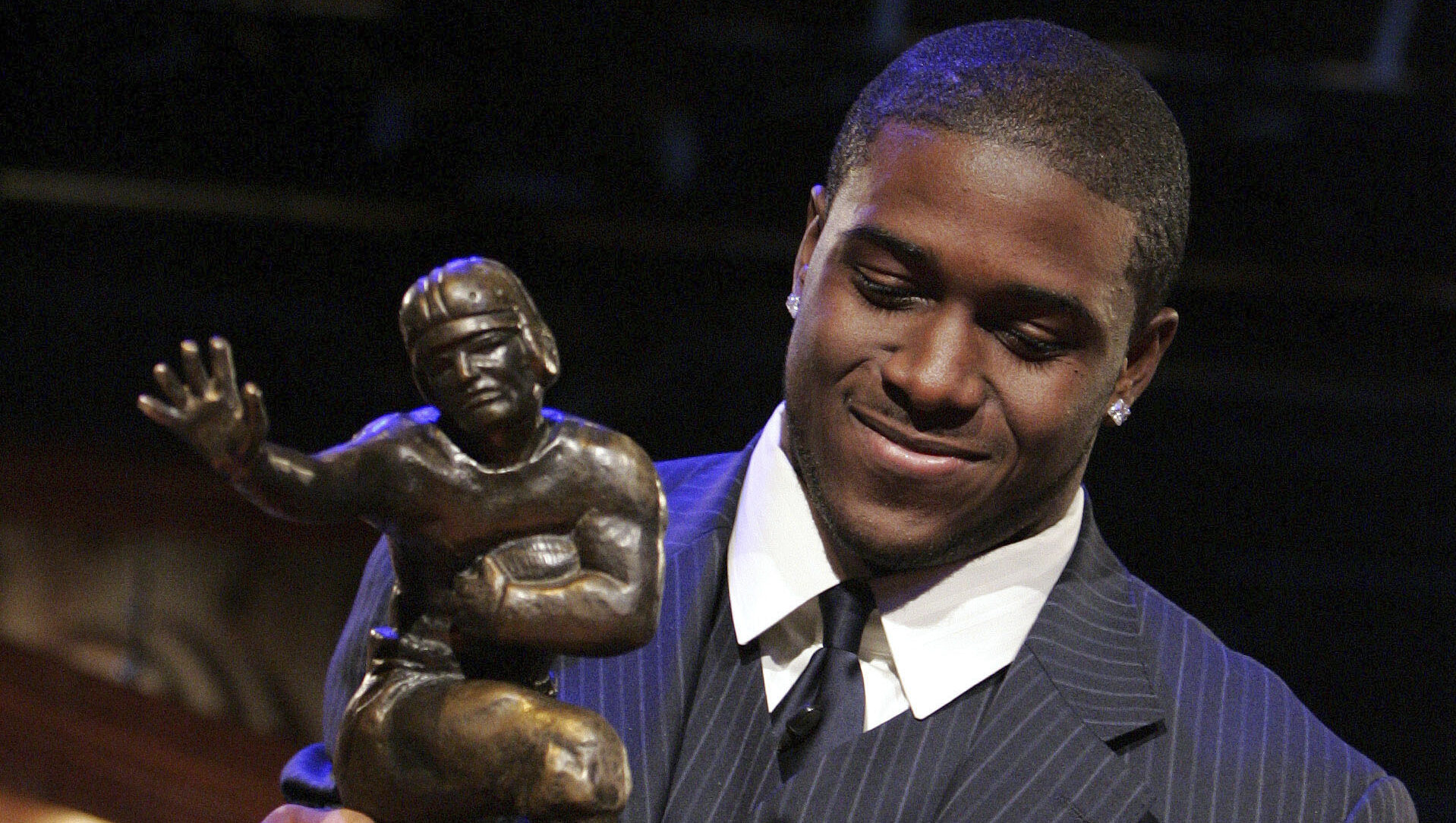

FILE - In this Wednesday, Feb. 26, 2020, file photo, stock trader Gregory Rowe works at the New York Stock Exchange. The S&P 500 has lost more than 10% from its record high as worries have built that a fast-spreading new virus will slam economies and corporate profits around the world. That means stocks just went through a “correction” in the stilted parlance of market watchers. (AP Photo/Mark Lennihan, File)

(AP Photo/Mark Lennihan, File)

NEW YORK (AP) — After six days of being pounded by a virus-induced, global sell-off, U.S. markets hit a milestone this week.

The S&P 500 dropped more than 14% from the record highs set just over a week ago, and continues to fall, as a fast-spreading new virus raises the specter of damaged economies and tumbling sales for companies in the U.S., Asia, Europe and elsewhere.

The S&P just went through a correction.

While that can be scary, particularly when a sell-off happens as fast as it did this week, corrections are fairly regular occurrences in the stock market. A correction can be a healthy event, eliminating excesses that have built up after extended runs of market optimism.

The stock market is still in the midst of its longest bull run on record, which began in March 2009 out of the ashes of the financial crisis.

The fear is that this correction may turn into another bear market: a drop of at least 20%.

Here’s a look at what history shows about past corrections, and what market watchers are expecting going forward.

Q: HOW OFTEN DO CORRECTIONS OCCUR?

A: Every couple years, on average. Even within this nearly 11-year-long bull run for U.S. stocks, the S&P 500 has stumbled to five corrections prior to this one, according to CFRA. In some, the market came within a breath of falling into a bear market, including a 19.8% fall in late 2018.

But each time, stocks regained their footing and resumed climbing again.

This is the 24th time in the last 50 years that the S&P 500 has fallen at least 10%, including both bear markets and milder corrections.

Q: DO THEY ALWAYS HAPPEN SO FAST?

A: No, this one has been particularly swift. Looking only at corrections since World War II, not at bear markets, it’s taken an average of 76 days for the S&P 500 to lose 10%, according to CFRA.

The S&P 500 has dropped 12% in a little more than a week.

Q: WHAT USUALLY HAPPENS AFTER A DROP LIKE THIS?

A: Looking only at corrections that managed to right themselves before turning into a bear market, the S&P 500 has taken an average of 135 days to find a bottom and lost 14% along the way, according to CFRA. But the ensuing recoveries have often been quick, and the index has taken an average of 116 days to recoup all its losses.

For declines that metastasize into bear markets, the damage is much worse. Going back to 1929, the average bull market has taken an average of 21 months to complete and brought with it a loss of nearly 40% for the S&P 500, according to S&P Dow Jones Indices.

Q: WHAT CAUSED THE LAST CORRECTION?

A: In late 2018, when investors were worried that the Federal Reserve was raising interest rates too quickly and could force the economy into a recession. They were also worried about the U.S.-China trade war, which was running hot at the time.

Q: WHAT HAPPENED AFTER THAT?

A: After hitting a bottom on Dec. 24, 2018, the stock market rocketed to one of its best years in decades. The S&P 500 returned 31.5% in 2019, including dividends.

The Federal Reserve halted its rate increases and cut rates three times last year, the first such cuts in more than a decade. Investors see low rates as steroids for stocks because they can boost profits, while also making rival investments such as bonds less attractive.

Q: WHAT’S THE FED DOING NOW?

A: The Fed has been on hold since last fall, but traders are increasingly betting that it will have to cut rates again soon to prop up the economy.

Expectations for such aid from China’s central bank and others around the world helped stocks hold up in the first few weeks of the virus outbreak. But doubts are rising now about how effective lower interest rates can be when the problem is people getting sick around the world.

Q: SO HOW BAD CAN THIS GET?

A: No one knows.

Medical experts can’t say how far the virus will spread and what its ultimate toll will be. With so much uncertainty, investors are left to guess how many factories will be shut, how many customers of companies will be quarantined and by how much corporate profits will ultimately be shorn. In the face of so much uncertainty, the impulse has been to sell stocks now and run to the safety of U.S. government bonds instead.

Some experts say the market was already primed for a decline, even before the threat of the virus escalated.

Stocks had become expensive, particularly when compared with how much profit companies are producing, leaving them more risky and vulnerable. Doug Ramsey, chief investment officer of the Leuthold Group, said he was also unnerved by recent signs of over-confidence in some corners of the market by retail investors.

“We could have had this size of a drop based on sentiment alone, without the coronavirus,” he said. “This could not have come at a worse time.”

__

AP Business Writer Alex Veiga contributed.