Don’t run out of money in your retirement | Potential retirement solutions to help you avoid the worst

Apr 7, 2021, 3:53 PM | Updated: Jan 4, 2023, 2:44 pm

Photo: Adobe Stock

This article about what to do if you might run out of money is presented by Teton Wealth Group.

This article about what to do if you might run out of money is presented by Teton Wealth Group.

No one plans to run out of money in retirement. But despite your best-laid plans, it can happen. For a retiree, running out of money can be a common fear. And for good reason. But there are some key signs that you might run out of money and a few things you can do to help prevent the worst from happening. Here are 5 key signs you will run out of money and what to do if you see any of these in your future.

1. You don’t have a long-term care plan

Photo: Adobe Stock

You could run out of money quickly in retirement if you end up needing long-term care but you don’t have a plan to pay for it. More than half of all adults turning 65 right now will eventually need long-term care. About 1 in 7 of them will need care for more than five years. That’s according to the Department of Health and Human Services. The costs are very high and they could easily eat away at your hard-earned nest egg.

What You Can Do

There are a few options, like finding a long-term-care insurance policy or a hybrid life insurance policy that will pay out if you end up in long-term care. You could even look at self-funding these if you have substantial savings.

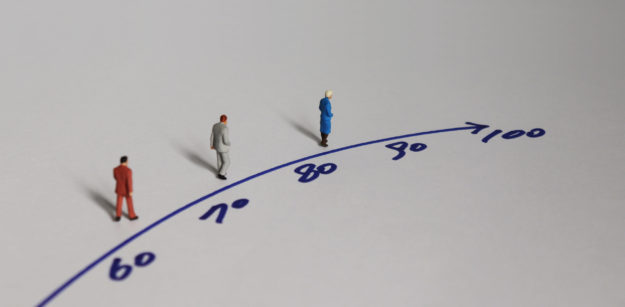

2. You underestimated your life expectancy

Photo: Adobe Stock

Your retirement could be more expensive than you thought if you live longer than you expected. Today around 1 in 4 65-year-olds will live to age 90 according to the Social Security Administration. If you only planned for 20 years of retirement and instead you live 30 years, you’ve got to figure out how to pay for 10 additional years.

What You Can Do

You shouldn’t rely on just one source of income in retirement. And that will help you counter outliving your savings. Things like annuities can help stretch retirement dollars. They let you take money out over time and not run out. A good advisor can help you plan your retirement to make sure you won’t run out of money no matter how long you live.

3. You didn’t plan for high healthcare costs

Photo: Adobe Stock

You’ll need to pay for healthcare in your retirement. But you might not realize how high that expense can be. Fidelity Investments estimates that a 65-year-old couple retiring in 2019 would need $285,000 to cover medical expenses in their retirement.

What You Can Do

When you are calculating how much you need to save for your retirement, be sure to add in your healthcare costs. They could be drastically higher than what you’re paying right now. Definitely choose the right Medicare option now. A good advisor can help you figure out the best healthcare too.

4. You didn’t take inflation into consideration

Photo: Adobe Stock

When you’re working, it’s easy to not feel the impact of inflation if your wages are rising along with prices. That means you might not consider inflation in your retirement savings calculations.

What You Can Do

Start by saving more in advance to prepare for inflation. Then consider delaying your Social Security benefits. You can maximize your Social Security benefit by waiting to claim it until you are 70 years old. Not only will your monthly check be bigger, but the Social Security Administration’s cost-of-living adjustment, which helps benefits keep up with inflation, can be applied to a bigger payout.

5. You loaned money to your kids

Photo: Adobe Stock

You could end up spending a lot more in retirement than you expected if you lend money to any of your children.

What You Can Do

This is where a solid financial plan will help you understand the risks of dipping into your retirement savings too early in order to help your kids.

You don’t want to run out of money in retirement

You should be aware of your blind spots in your retirement planning. Working with qualified advisors like the advisors at Teton Wealth Group can really help you get to where you want to be in your retirement.

-

- Income

- Investments

- Taxes

- Health Care

- Legacy