Truth-in-Taxation law holds taxes in check while property values rise in Utah

Aug 11, 2021, 5:00 AM | Updated: Feb 23, 2023, 1:28 pm

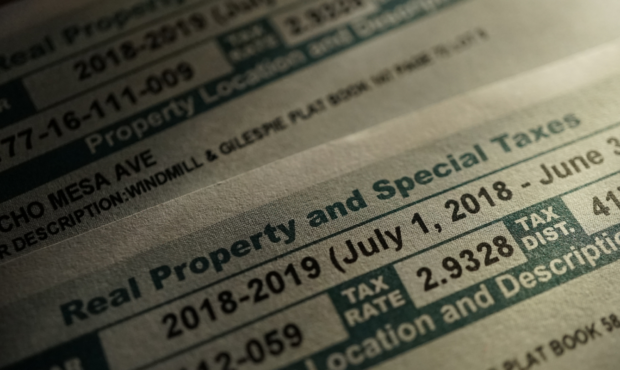

[Photo Credit: Canva Images]

SALT LAKE CITY — With the increase in property values over the past couple of years, some Utah residents are worried property taxes might rise just as fast. But Utah’s Truth-in-Taxation law means local governments don’t get an automatic windfall.

Former State Senator Howard Stephenson is one of the architects of Utah’s Truth-in-Taxation law.

“If you’re seeing a huge increase in values because home prices are skyrocketing,” Stephenson told KSL NewsRadio, “the certified tax rate comes down so that that taxing entity gets no more money than the previous year.”

If a city or a school district needs more than they got last year, plus a little for growth, they have to publish a notice and hold a Truth-in-Taxation hearing.

Alpine School District held theirs last night. Board President Mark Clement argued that a 4.5% tax increase is not unnecessarily burdensome.

“It’s on the order of $40 or so a year, which is really a couple of trips to the hamburger shop, and yet the return is now we can educate our kids. We can provide better resources for them and I just think it’s a great investment.”

At Tuesday night’s public hearing, Allison Morris was having none of it.

“Stop overspending on schools,” she said. “My gosh – they’re a palace. We don’t need that.”

After the hearing, the Alpine District board passed the tax increase unanimously.

Utah’s Truth-in-Taxation law was passed in 1985 and modeled on a statute from Florida. A 2018 study by Utah Foundation concluded the Truth-in-Taxation law has prevented property taxes from rising as quickly as property values.

But the law is not without critics. Among other things, it still requires legal notice to be published in newspapers. Cameron Diehl, executive director of the Utah League of Cities and Towns, says that communication with taxpayers is one area where the law could be improved.

“At times, that specific language in state law can really complicate or mislead the public about what’s really being proposed,” he told KSL Newsradio in an interview.

Even with its faults, Utah’s law has been held up as exemplary, getting new attention at the recent American Legislative Exchange Council meetings in Salt Lake City.

Truth-in-Taxation hearings for other entities are listed on the annual tax notice mailed to property owners.