Student loan forgiveness resolution on hold until 2023

Dec 6, 2022, 5:00 PM | Updated: Dec 7, 2022, 7:59 am

Students walk on campus at the University of Utah in Salt Lake City on Tuesday, Aug. 23, 2022. (Jeffrey D. Allred/Deseret New)

(Jeffrey D. Allred/Deseret New)

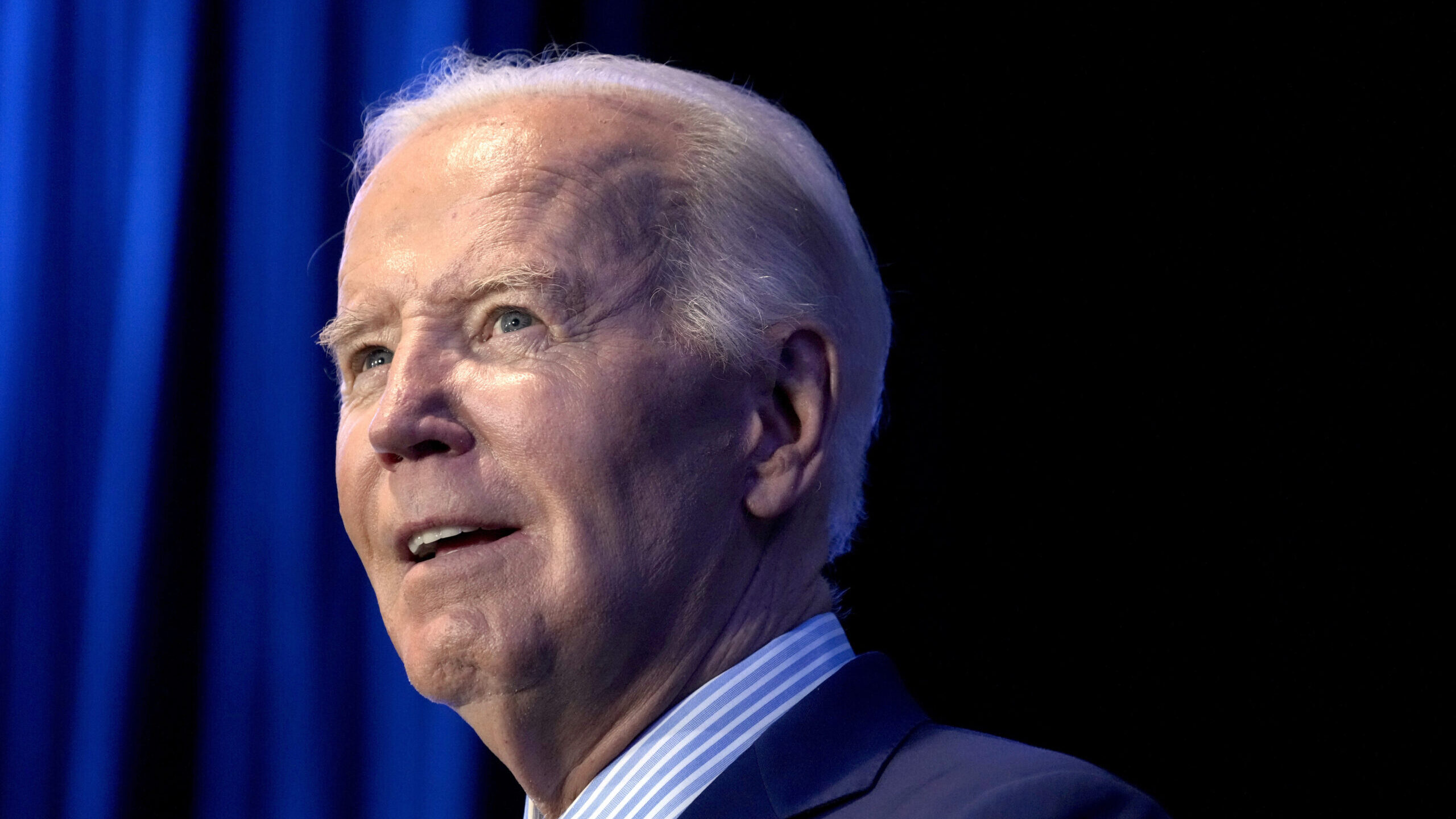

SALT LAKE CITY — Uncertainty continues to loom as President Joe Biden’s student loan forgiveness program remains blocked. The program will stay on hold until the Supreme Court makes a ruling about it next June.

What’s going on with the student loan forgiveness program?

Jason Iuliano, associate professor of law for the University of Utah spoke to Dave and Dujanovic about where the case is so far.

Iuliano said the court issued a writ of certiorari, which calls for a quick resolution because of the importance of the case.

“To put that in perspective, between 1988 and 2019, it’s only been granted three times. And so this is a very, very unusual procedure to get before the Supreme Court.”

Because of the writ, the Supreme Court will hear arguments about the program sometime around February 2023 and issue a ruling in June 2023.

Next steps

Iuliano believes there’s a high chance the Supreme Court will strike the program down.

“Odds are the Supreme Court finds that the forgiveness overstepped the bounds of the executive authority,” Iuliano said.

Though the Supreme Court’s decision will focus on student loan actions, Iuliano said the decisions made by lower courts could make waves.

Iuliano said the lower courts invoked the Major Questions Doctrine.

“What that says is that when Congress delegates action, if it’s very, very sweeping in magnitude, the power that they’re giving to the executive, they need to be very, very explicit in the bill, that this is the type of power that they want the President to have.”

That doctrine could be in other cases about recent executive actions.

“This is a much, much bigger case than just student loan debt,” Iuliano said.

Alternative routes

Iuliano said that, for those who can’t afford to make payments toward their student loan debt, bankruptcy can be an option.

Though it’s a common belief that filing for bankruptcy won’t eliminate student debt, Iuliano said about 50% of people who file have their student debt discharged.

While the Department of Education often fought against student loan debt being wiped out, it made a recent move that might make things easier on debtors.

“The Department of Education has actually come out with these set of standards for their own internal criteria for when they will stop challenging these cases,” Iuliano said.

Iuliano said he was more optimistic about filing for bankruptcy than he was about the chances the Supreme Court upholds Biden’s program.