Property valuation appeals down across Salt Lake Valley

Sep 14, 2023, 7:30 PM

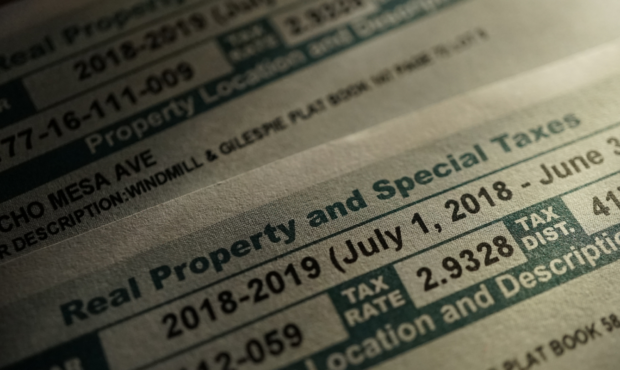

[Photo Credit: Canva Images]

SALT LAKE CITY — Friday marks the deadline for homeowners in Utah to file appeals for their property tax valuation, but at least in the Salt Lake Valley and along the Wasatch Front, the number of appeals appears to be on a decline.

“The last three years have been the lowest appeal rates over 40 years, and we’re trending similar to the last two years,” said Chris Stavros, Salt Lake County assessor.

He told KSL NewsRadio since taking office, reducing the number of appeals has been a goal of his.

“You know, we currently have 385,778 parcels, and our appeal rate’s less than one percent,” he said.

Assessors in Tooele County and Davis County also reported their appeals rate trending downward.

How property tax valuation appeals work

Appeals need to be filed between August 1 and September 15 each year. Therefore, the numbers may change, but none of the assessors expected the overall trend to change.

Homeowners may file appeals of their property tax valuation online or by mail, so long as the appeal is postmarked by September 15. Additionally, homeowners who qualify can file a late appeal through the end of March. Among other things, the criteria include a medical emergency, the death of a property owner or immediate family member, a factual error in the county’s records, the property valuation notice did not arrive, or other “extraordinary and unanticipated circumstances.”

In Salt Lake County, property tax valuation appeals go through the county auditor’s property tax division. That office maintains a page of resources walking homeowners through the process, here.

Making sure your data is correct

Stavros said his office strives to ensure their property data is as accurate as possible. Property tax valuation assessments are based on the fair market value of the home as of January 1. He recommends homeowners check their property’s data on the assessor’s website to ensure what the county knows about a given property matches the reality on the ground.

“I never want anyone to pay the wrong amount of tax because we got their valuation wrong. That’s very important to me and I take that responsibility and obligation very seriously,” he said.

Read more: