The 2021 tax filing season has begun. Here’s what you need to know

Jan 24, 2022, 9:16 PM

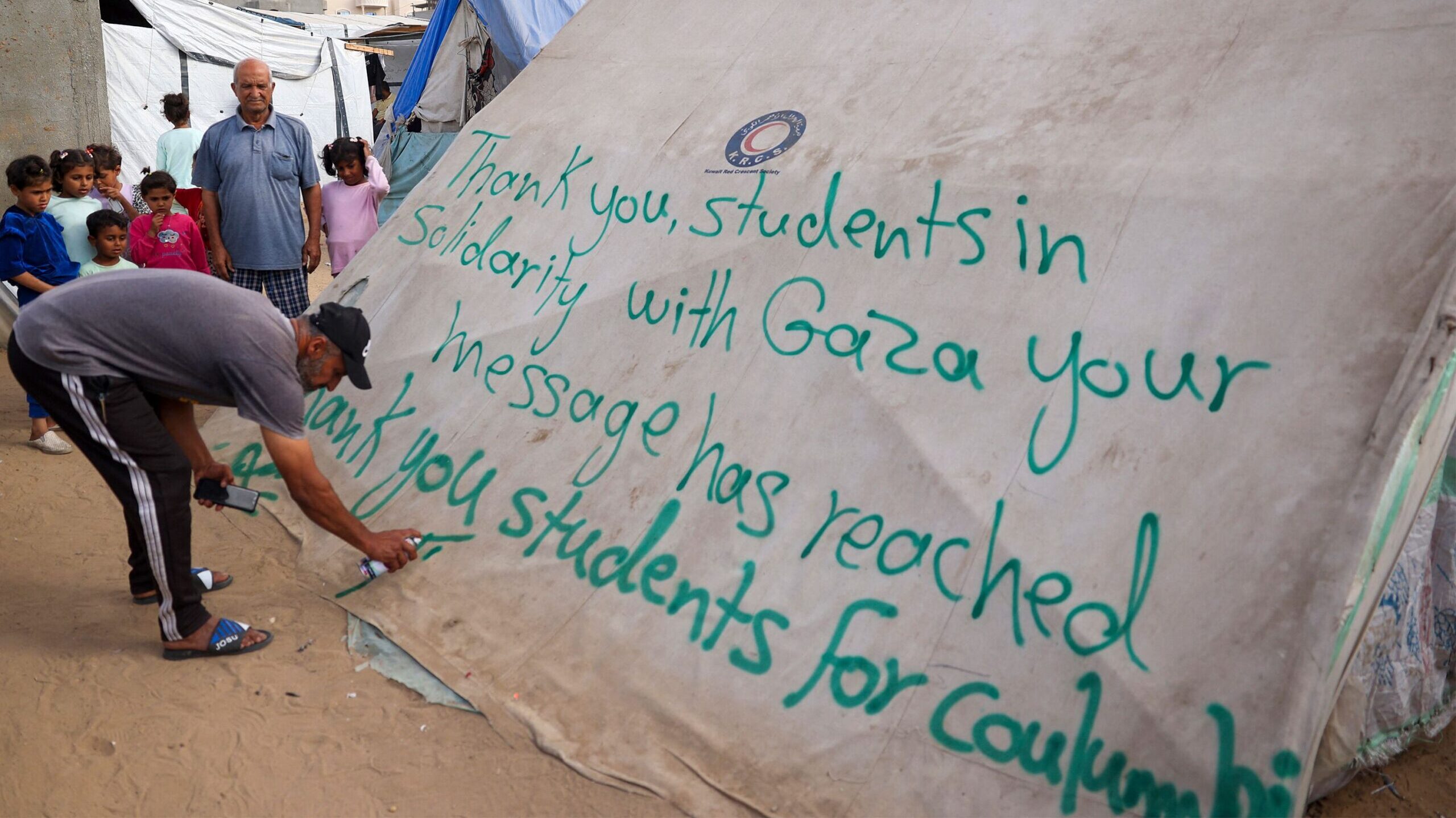

The federal tax filing season has begun. And it's going to be tough sledding for the IRS -- and for some tax filers -- given the millions of returns from last year that still have to be processed, staffing issues due to Covid-19 and a lack of needed funding for the agency. Photo credit: Adobe Stock

(CNN) — The federal tax filing season has begun. And it’s going to be tough sledding for the IRS — and for some tax filers — given the millions of returns from last year that still have to be processed, staffing issues due to Covid-19 and a lack of needed funding for the agency.

Despite that, there are still ways to help ensure your tax filing experience is hassle-free and you get your refund within the typical 21-day window after the IRS accepts your return.

This requires three critical steps on your part. “File electronically. File accurately. And request direct deposit for your refund,” IRS Commissioner Charles Rettig said Monday in a press call. “If there’s a problem with your return it can create an extensive delay.”

As you aim for accuracy, keep in mind the many tax-related variables from last year — such as receiving a third stimulus payment or advanced payments of the expanded child tax credit.

Here’s what you need to know about filing your 2021 taxes this year:

The filing deadline

The federal tax filing deadline this year is Monday, April 18. That’s the day by which you must have filed your 2021 individual return and paid any remaining federal income taxes owed for last year.

Normally, the tax-filing deadline is April 15, but this year that is when Emancipation Day will be observed in Washington, DC. In two states — Massachusetts and Maine — the federal filing deadline will be April 19 due to the observation of Patriots Day on the 18th.

The deadline will be extended for anyone who files for an automatic 6-month extension. (Note: you will only be granted an extension to file your return. But you will not be given an extension to pay what you owe.)

In addition, the tax filing and payment deadlines will be extended for anyone living in counties declared federal disaster areas due to recent natural calamities.

These include tornado and storm victims in Arkansas, Illinois, Kentucky and Tennessee, as well as wildfire victims in Colorado. They will have until May 16, 2022, to file various individual and business tax returns and make their payments. (This IRS page offers a complete listing of who is granted disaster-related tax extensions.)

Those affected taxpayers also will have until May 16 to make 2021 IRA contributions. Everyone else must make their 2021 IRA contributions no later than April 18.

Don’t be surprised by delays

While every tax season is busy for the IRS, pandemic-induced backlogs from the past two years coupled with limited funding will make the current tax season even more so.

The IRS has 6 million individual returns from last year that still need to be processed, or 11 million in total including unprocessed business and other returns.

The return processing and tax assistance delays arose as the agency was administering several Covid-19 relief efforts passed by Congress. Those included issuing three rounds of Economic Impact Payments, creating a system to send out advance monthly payments of the Child Tax Credit and making changes to the Earned Income Tax Credit.

One example: Last year, the agency was unable to answer more than two-thirds of the calls it received.

This year is likely to be just as frustrating. That’s why tax filers are encouraged to first use the online tools provided on IRS.gov to get answers to their questions before reaching out to the agency directly.

“Expect phones lines to be jammed up for the forseeable future,” Rettig said.

Be on the lookout for IRS letters

If you received advanced payments last year for the recently expanded child tax credit or you got a third stimulus payment (a.k.a. Economic Impact Payment) last spring from the IRS, be on the lookout for a letter pertaining to each from the agency.

It made advanced monthly payments on the child tax credit from July through December. So you may already have received about half of your credit and can claim the other half on your 2021 return.

To help with that calculation, the IRS will send you Letter 6419 for the child tax credit advanced payments, which you should use to reconcile how much more you are due on your return.

Similarly, you will receive Letter 6475 for the stimulus payment detailing the amount you’ve received and can use that to reconcile the amount you are due on your return.

If you have questions or concerns about the amount reported in your letter, create or check your existing online tax account at IRS.gov, which should have the latest number on record with the agency, Corbin said.

How to ensure you get your refund as quickly as possible

The majority of tax filers are typically owed a refund.

The IRS is likely to deliver your refund within 21 days of receipt — its typical turnaround time — but only if you fill out your return accurately and completely, file it electronically and opt to have your refund delivered through direct deposit.

For anyone expecting a refund due to the Earned Income Tax Credit or Additional Child Tax Credit, the IRS is prohibited by law from issuing it before mid-February in order to give the agency time to stop fraudulent refunds from going out. But affected filers may still file their returns beginning on January 24.

Corbin noted that due to holidays, weekends and bank processing time, filers expecting refunds due to the EITC and ACTC should expect to see them starting in early March.