RACE, RELIGION + SOCIAL JUSTICE

Genealogy research now tax deductible for members of The Church of Jesus Christ of Latter-day Saints

Nov 29, 2022, 12:00 PM | Updated: Jan 16, 2023, 3:26 pm

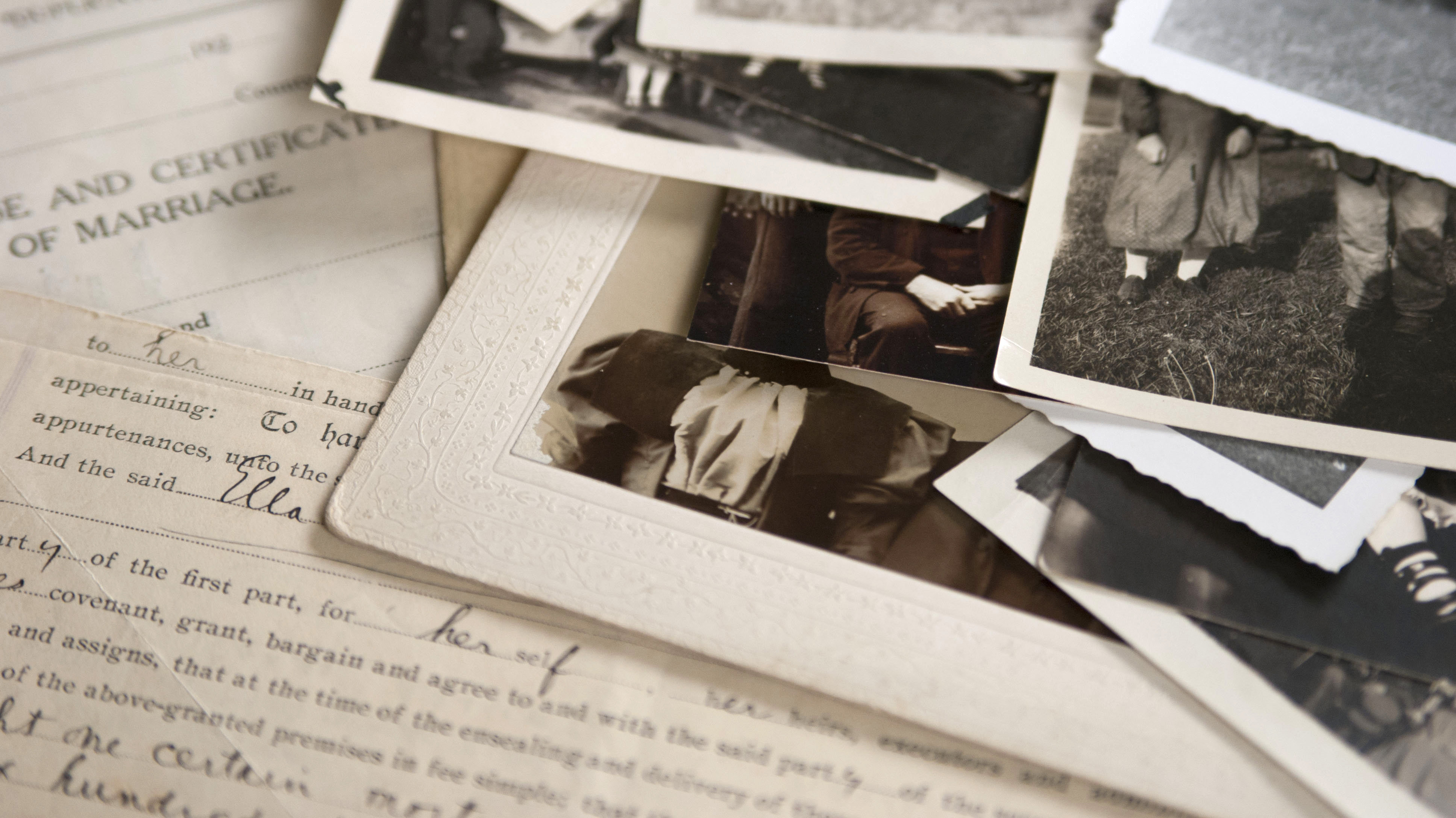

Researching and building genealogy is encouraged by The Church of Jesus Christ of Latter-Day Saints. Photo: Getty Images

SALT LAKE CITY — Members of The Church of Jesus Christ of Latter-Day Saints who want to learn more about their family history through Genealogy tests, can compile the research and categorize it as tax-deductible.

Contextually, The Church of Jesus Christ of Latter-Day Saints encourages its’ members to receive genealogy tests. This is to trace back their bloodline in the form of pedigrees.

As a result, the International Revenue Service is offering some relief.

“As part of the discipline of the Church, the members are encouraged to create family groups to study the genealogy of the family back to Adam and Eve,” the revenue ruling outlines.

The revenue ruling explains the research helps members fulfill their required responsibilities of providing for family exaltation. The expenses of genealogical research are financed by membership fees.

Professional genealogists are working for the church to conduct religious research.

More specifically, the church is using Legacy Tree Genealogists. Participating members can make payments for their research services through a nonprofit organization like the Religious Family History Corporation. Using this method will allow the research to be tax deductible.

“We pride ourselves on being innovators within the industry,” said Legacy Tree president, Jessica Taylor in a press release. “[We] will continue to lead out on ensuring everyone has access to professional genealogy research assistance and can experience the satisfaction that comes from connecting with one’s roots,”

Bonneville International Corporation, the company that owns KSL NewsRadio, is a subsidiary of Deseret Management Corporation, which is owned by The Church of Jesus Christ of Latter-day Saints.

Related reading