Could doing your taxes be free and easier?

May 17, 2023, 12:00 PM

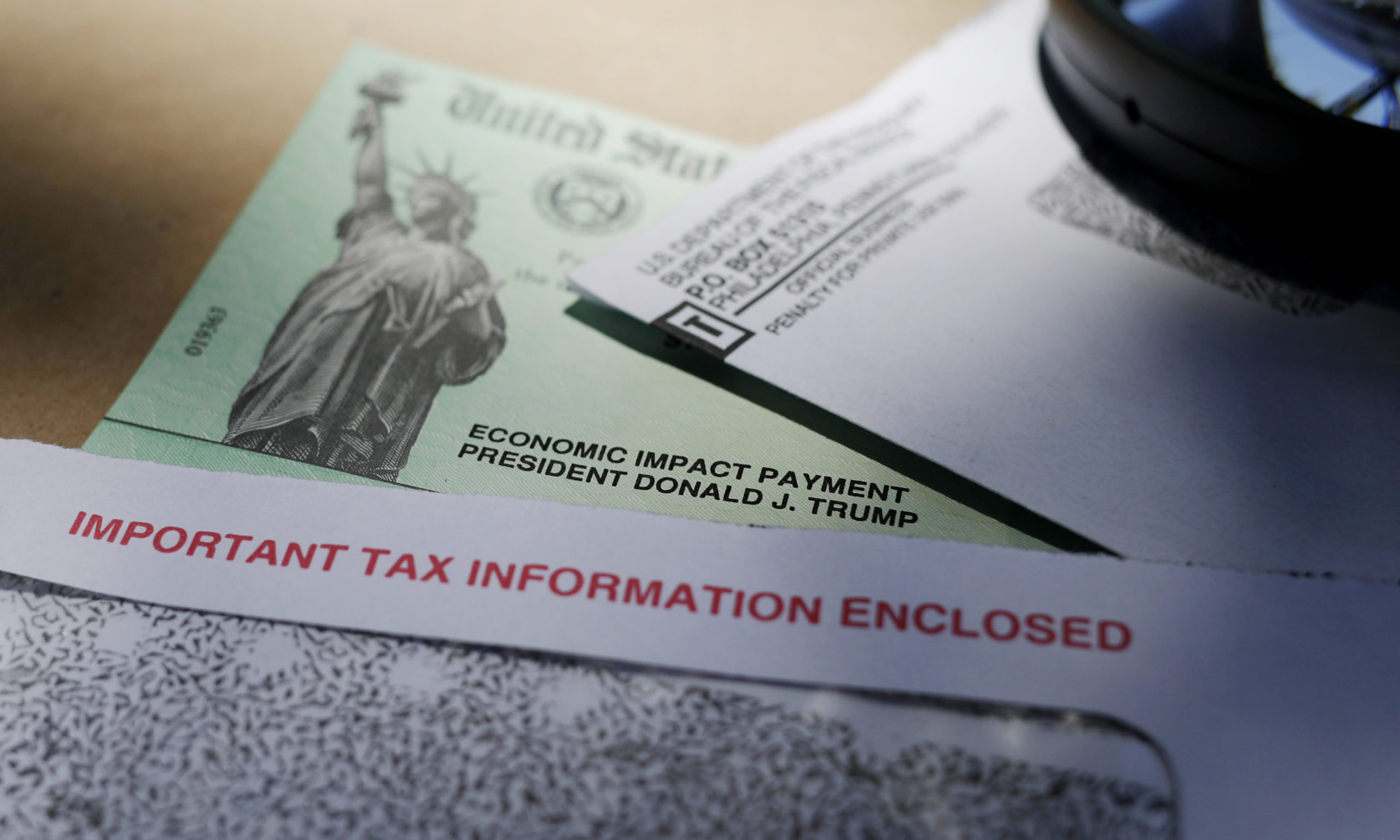

Doing your own taxes can be expensive and intimidating. (Eric Gay/AP Photo)

(Eric Gay/AP Photo)

WASHINGTON, D.C. — The IRS released a report this week saying it’s adopting its own direct file system to help you in doing your taxes. Think TurboTax or H&R Block — but free and on the IRS website.

Is that a good idea?

“If you’re a W-2 wage earner with a little bit of ancillary investment income, why not?” asked Susan Spiers, CEO of the Utah Association of CPAs. “I think we need to keep an open mind. The digital revolution is going to continue to go forward, whether we like it or not.”

Who will this be for?

This free tax preparation and filing service is targeted at the individual or couple with a simple tax return. It may work for you if you take the standard deduction and don’t have a lot of income sources.

“Just under 50% of the American taxpayers in the nation could probably benefit from a system like this,” Spiers said. ‘We know that many countries are doing things like this.”

Spiers has some hesitation, however.

“The number one challenge is people don’t trust the government,” she said. “I have never met anyone in all my years of practice who trusts the IRS.”

The IRS already has free help available on its website if you make $73,000 or less.

“Here in Utah, and many people don’t know this, you can go to the Utah State Tax Commission website and file a free state income tax return,” Spiers explained.

Pluses and minuses of doing your taxes yourself

Spiers thinks this kind of free service “is going to pull in taxpayers that maybe haven’t filed that should have.”

She says some taxpayers have just been too intimidated by the process, “but if it was simplified for them, maybe they would tend to be more law-abiding.”

Two things to keep in mind during tax season

One of the risks, though, involves the number of mistakes that are made on forms filed with the IRS. “Forty-six percent of W-2s have errors,” Spiers said.

If those errors aren’t caught, the IRS and Social Security won’t likely catch them for two to three years.

Would this put TurboTax out of business?

Tax preparation companies are boosting their lobbying efforts. It looks like they are very concerned about the IRS offering for free what they have been charging for.

“I think if TurboTax and Intuit are afraid of losing their shorts, maybe they ought to become part of the solution,” Spiers said.