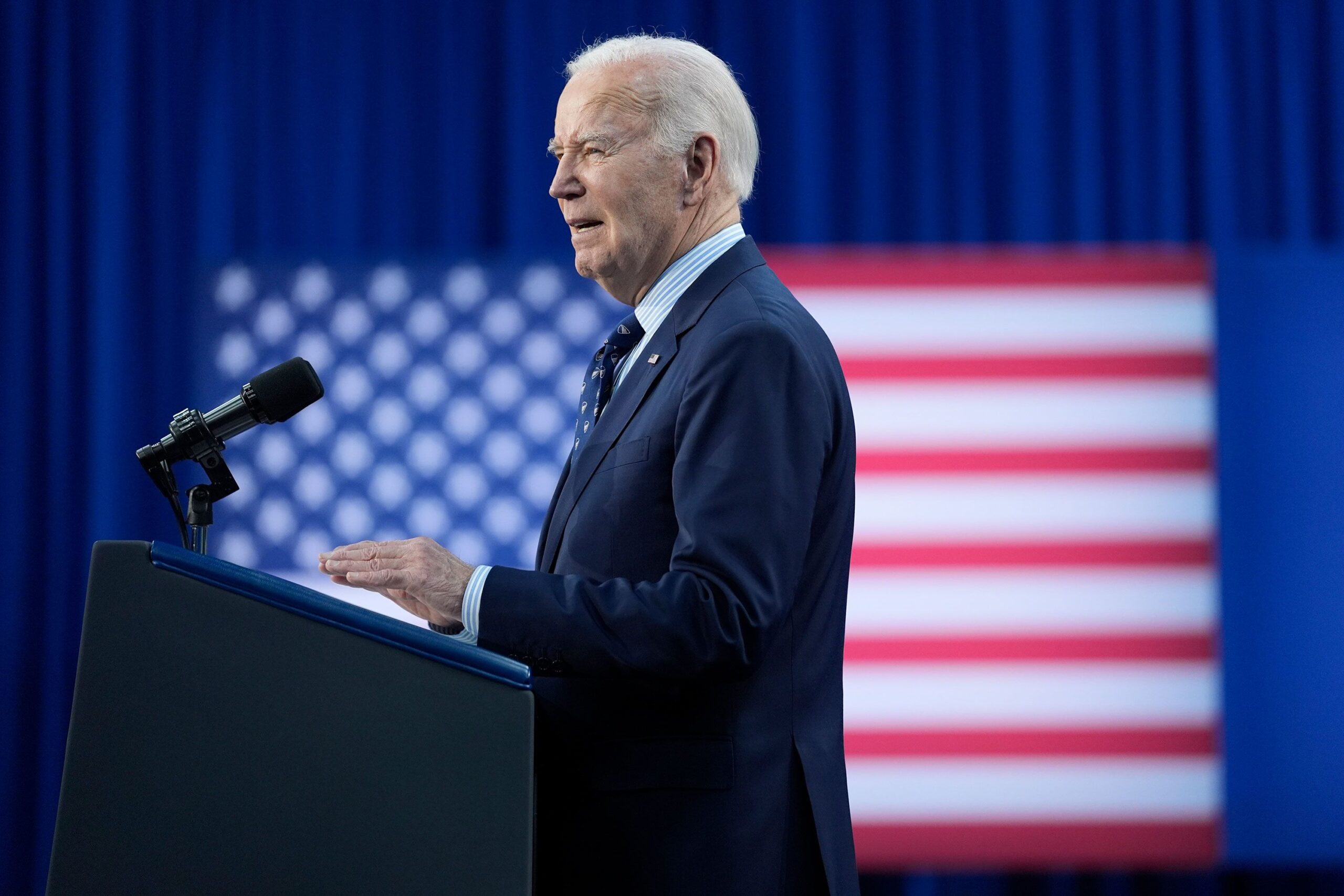

Washington (CNN) — The Biden administration said Friday that is using existing student loan forgiveness programs to cancel another round of student debt, totaling $7.4 billion for 277,000 borrowers.

Under President Joe Biden, the Department of Education has made it easier for some specific groups of borrowers, like public sector workers, to qualify for loan forgiveness. It also launched a new repayment plan that creates a shorter pathway to loan forgiveness for many low-income borrowers – and is at issue in at least two legal challenges from Republican-led states.

In total, the Biden administration has authorized the cancellation of $153 billion in student loan debt for nearly 4.3 million people. That’s more than 9% of all outstanding federal student loan debt.

As the November election approaches, the Biden administration has been eager to show how much student loan debt it has canceled, making new announcements about debt relief roughly once a month and sending emails directly to eligible borrowers. Earlier this week, Biden announced a new group of student debt relief proposals that could possibly go into effect this fall.

Biden’s student loan forgiveness efforts have been sharply criticized by many Republicans, who argue the president is transferring the cost to taxpayers who chose not to go to college or who already paid for it themselves. They also say he is circumventing the Supreme Court, which knocked down Biden’s signature student loan forgiveness program last year.

In the past few weeks, two groups of Republican-led states have sued the Biden administration over the income-driven repayment plan launched last year. Known as SAVE (Saving on a Valuable Education), the plan offers the most generous terms for low-income borrowers.

About $3.6 billion of the student debt relief announced Friday will be delivered to people enrolled in the SAVE plan.

“Republicans in 18 states want to prevent their own constituents from benefiting from the SAVE plan. They want to end SAVE, make their constituents’ payments go up and keep them under mountains of loan debt with no end in sight,” said White House press secretary Karine Jean-Pierre on a call with reporters Thursday.

How loan forgiveness works under new SAVE plan

Since SAVE launched last year, nearly 8 million borrowers have enrolled and about 360,000 people have seen their remaining debt canceled due to the terms of the new plan.

Before SAVE, the federal government already offered several income-driven repayment plans, which tie monthly payments to a borrower’s income and family size. But under Biden’s new version some borrowers will see their monthly payments cut in half when the plan is fully phased in this July.

There’s a forgiveness component for borrowers once they’ve made monthly payments for a certain number of years under SAVE. That’s true under other income-driven repayment plans, too, but the time it takes to receive debt relief is shorter under SAVE and based on how much the borrower initially took out. For example, those who borrowed $12,000 or less will see their debt forgiven after paying for 10 years, compared with the 20-plus years it may take if enrolled in another plan.

Another benefit to borrowers enrolled in SAVE: Unpaid interest will not accrue as long as full monthly payments are made. That means a borrower’s balance won’t increase even if the monthly payment doesn’t cover the interest accumulated that month.

Other efforts to cancel student debt

Biden attempted to implement a sweeping student loan forgiveness program in 2022, but it was knocked down by the Supreme Court before it delivered any debt relief. The program would have wiped away up to $20,000 for borrowers earning less than $125,000 a year – and was estimated to cost about $400 billion.

The high court ruled that the administration overstepped its authority.

Still, Biden has canceled more student loan debt than under any other president – mostly by using existing programs. His administration has made it easier for certain groups of borrowers – such as public-sector workers, including teachers; disabled borrowers; and people who were defrauded by for-profit colleges – to qualify for student loan debt forgiveness.

The Department of Education is also conducting a recount of past payments to fix administrative errors, bringing some people closer to debt relief.

Since the fall, the Biden administration has been working on set of new proposals, based on a different legal authority, to deliver relief to certain groups of borrowers.

For example, those whose student loan balances are bigger than what they initially borrowed could see their accumulated interest wiped way.

Those proposals have yet to be finalized, but some could go into effect as soon as this fall, according to administration officials.

The-CNN-Wire

™ & © 2024 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.